how much federal taxes deducted from paycheck nc

For federal income tax purposes the contribution limitation for cash contributions for tax year 2021 is 100 of an individuals adjusted gross income AGI. Therefore a taxpayer must determine federal adjusted gross income before beginning the North Carolina return.

Payroll Software Solution For North Carolina Small Business

See how your refund take-home pay or tax due are affected by withholding amount.

. North Carolina Deductions From Pay. Source income received by a foreign person are subject to US. Choose an estimated withholding amount that works for you.

However NO deductions can be made from the full. If the taxpayer is not filing a federal income tax return the taxpayer must complete a schedule showing the computation of federal. North Carolina moved to a flat income tax beginning with tax year 2014.

Deductions for the employers benefit are limited as follows. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. Tax of 30 percent.

Your 2021 Tax Bracket To See Whats Been Adjusted. There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate that will be deducted. Plus to make things even breezier there are no local income taxes.

Our calculator has been specially developed in order to provide the users of the calculator with not. For tax year 2021 all taxpayers pay a flat rate of 525. Detailed North Carolina state income tax rates and brackets are available on this page.

How It Works. For 2022 its limited to 6 of the first 7000 of an employees wages each year. How much is taken out of my paycheck for taxes in NC.

That rate applies to taxable income which is income minus all qualifying deductions and exemptions as well as any contributions to a retirement plan like a 401k or an IRA. Use this tool to. This is true even if you have nothing withheld for federal state and local income taxes.

North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of. Ad Deductions for Healthcare Mortgage Interest Charitable Contributions Taxes More. The starting point for determining North Carolina taxable income is federal adjusted gross income.

Everything is included Premium features IRS e-file Itemized Deductions. There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted. Estimate your federal income tax withholding.

If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire. The only other thing you need to worry about is North Carolina State Unemployment Insurance. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

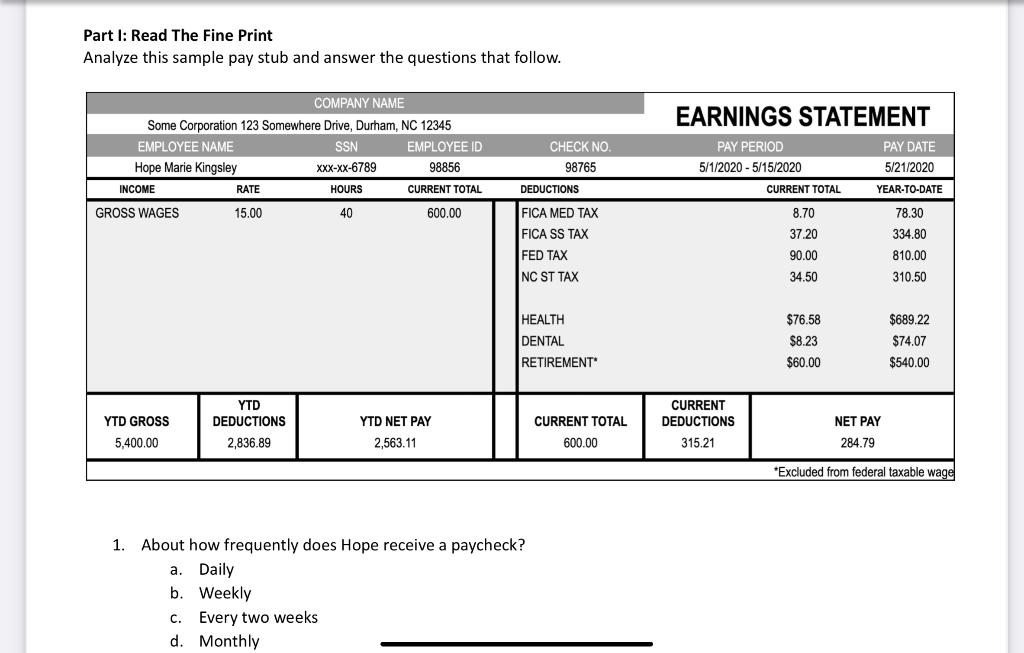

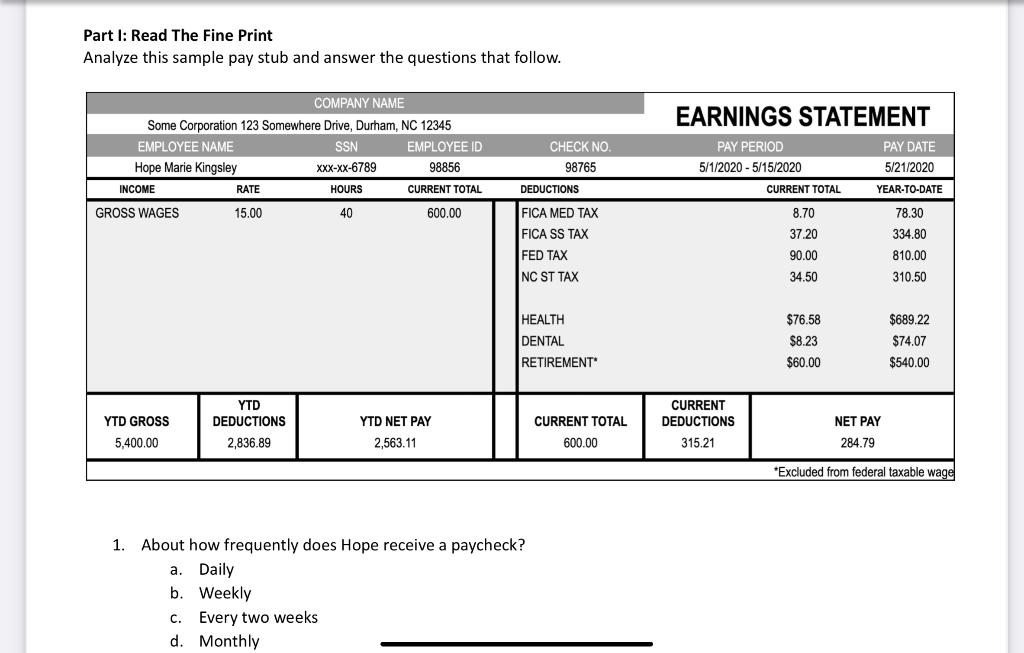

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Most types of US. Employee Pay Stub.

The tax is generally withheld Non-Resident Alien withholding from the payment made to the foreign person. Gross Pay Federal Income Tax Withholding. Many employers will qualify for tax credits to reduce the rate to 06 by paying their state unemployment taxes on time.

919 814-4590 Office hoursin-person form deliveries Mon-Fri 800 am - 500 pm Call Center. Discover Helpful Information And Resources On Taxes From AARP. Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019.

You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. For North Carolina income tax purposes the charitable contribution limitation is 60. Medical and Dental Expenses.

A in non-overtime workweeks wages may be reduced to the minimum wage level but cannot go below the minimum wage currently 725 an hour and b during overtime workweeks wages may be reduced to the minimum wage level for the first 40 hours. The North Carolina income tax has one tax bracket with a maximum marginal income tax of 525 as of 2022. Plus to make things even breezier there are no local income taxes.

Ad Compare Your 2022 Tax Bracket vs. And like North Carolina employers are solely responsible for paying FUTA tax.

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Here S How Much Income You Need To Afford Rent In Every State Huffpost Rent Map Apartment Cost

North Carolina Income Tax Calculator Smartasset

Irs Form 1096 Irs Forms Irs Internal Revenue Service

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Where Your State Gets Its Money

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

It S Tax Season Use Your Refund To Jump Start Your Down Payment Savings

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

State Corporate Income Tax Rates And Brackets Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Income Tax Calculator Smartasset

Solved Part I Read The Fine Print Analyze This Sample Pay Chegg Com

North Carolina Providing Broad Based Tax Relief Grant Thornton

In No State Can A Minimum Wage Worker Afford A Two Bedroom Unit At Fair Market Rent Working A Standard 40 Hour Work Week Minimum Wage Wage The Unit

North Carolina Income Tax Calculator Smartasset

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself